Arthur J. Gallagher & Co. (Gallagher), a publicly traded insurance brokerage headquartered in Illinois, employs approximately 44,000 people globally and holds a 4.6 percent share of the US insurance brokerage market. Considered an industry “All Star” for its above-average market share, revenue, and profit growth, Gallagher operates across a diversified portfolio of trading entities, including Gallagher Re, RPS, Artex, Alesco, and Gallagher Bassett. In recent years, its strategic intent has centered on consolidating its position as a global brokerage cornerstone alongside Marsh McLennan, Aon, and WTW. From 2018 to 2023, Gallagher’s revenue has surpassed WTW to rank it as the third largest worldwide.

This report examines Gallagher’s positioning through five critical lenses: mergers, acquisitions, and history; financial overview; sector involvement; market capitalization strategy; and leadership. Each section provides a detailed account of Gallagher’s operational posture, strategic differentiators, and exposure to market and regulatory risks.

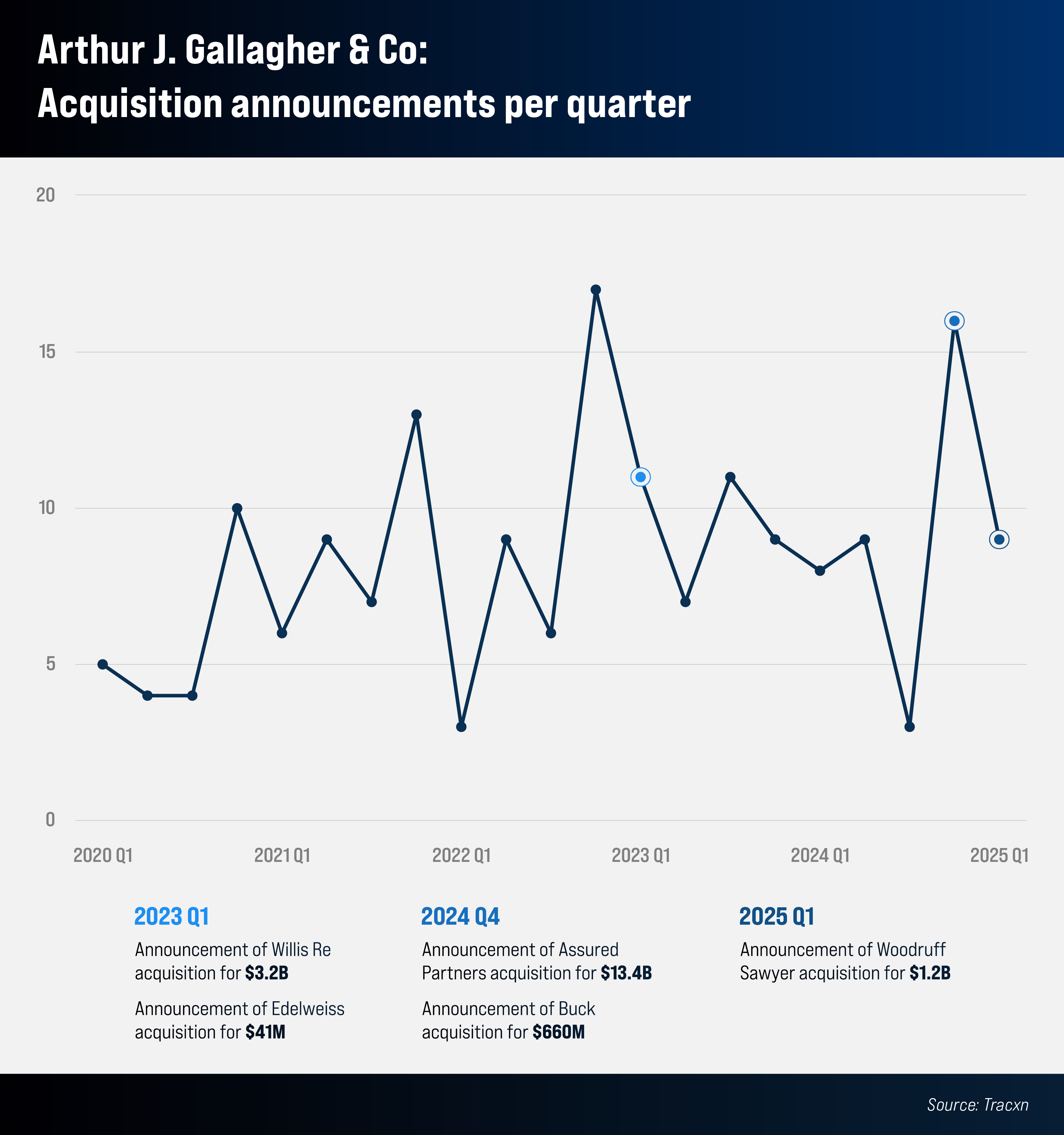

The mergers, acquisitions, and history segment documents Gallagher’s sustained expansion via acquisition: 331 deals since inception, including 178 since 2020. The analysis highlights the firm’s consistent preference for scale-driven growth and multisector diversification. Landmark transactions, such as the proposed $13.45 billion acquisition of AssuredPartners and the $3.25 billion purchase of Willis Re, underscore Gallagher’s efforts to consolidate niche capabilities across reinsurance, HR consulting, and specialty insurance. Gallagher’s mergers and acquisitions (M&A) approach is distinguished not only by volume but also by its robust post-integration methodology. The firm imposes operational and cultural cohesion via “The Gallagher Way,” an internal integration framework that emphasizes centralized systems while preserving some producer autonomy.

In the financial overview, the report outlines how Gallagher’s revenue has more than doubled since 2020, while total assets have nearly tripled. Commissions and fees now account for 89 percent of total revenue, supported by the firm’s aggressive reinvestment of cash flow into acquisitions. Key financial indicators highlight Gallagher’s preference for capital deployment over short-term liquidity preservation, such as the rise in goodwill to $12.2 billion, significant debt growth to $12.9 billion, and increasing amortization costs. The report also notes regulatory scrutiny associated with certain tax-advantaged insurance arrangements and the increasing concentration of financial risk on continued M&A execution.

The sector involvement section dissects Gallagher’s business across brokerage and risk management. Brokerage accounts for 86 percent of revenue, with middle-market commercial lines and specialty verticals comprising its core client base. Risk management, led by Gallagher Bassett, accounts for the remaining 14 percent, with service lines in workers’ compensation, auto liability, and claims consulting. The report notes that Gallagher’s positioning in the middle market enables higher growth potential but also exposes it to competitive pricing pressures and potential client churn in economic downturns.

Gallagher’s market capitalization strategy is examined through the lens of recent equity issuance and shareholder structure. In 2024, the company raised $8.4 billion through a 30 million-share public offering (its largest in years) to fund the AssuredPartners transaction. Private equity investors Vanguard and BlackRock maintain significant influence over governance, and insider ownership remains low. The report considers the implications of Gallagher’s growing reliance on public equity markets for strategic flexibility, particularly in a rising interest rate environment.

Finally, the leadership and governance section analyzes the firm’s executive and board structure. Gallagher maintains a blend of familial continuity and strong external expertise. While the Gallagher family occupies several senior leadership roles, the board includes directors with backgrounds in leading energy companies, healthcare, financial services, and the Lloyd’s market. The report evaluates potential governance risks arising from familial concentration alongside the benefits of institutional knowledge and long-term strategic coherence.

Taken as a whole, the report provides a comprehensive analysis of Gallagher’s competitive positioning, operational execution, and strategic intent. Particular emphasis is placed on the balance between rapid inorganic expansion and the legal, regulatory, and operational complexities that accompany such growth.

“Right now, there are three big, large account, commercial (underwriters). Especially with (recent acquisition activity), Gallagher is actually moving up in account size, pushing into Marsh, Aon, and WTW’s businesses strategically. This is interesting, because those firms are going in the other direction... Gallagher is going larger, and the other big three are going smaller,” said Paul Newsome, a sector analyst, in an interview for this report.

Information sources for this report include interviews with sector analysts Paul Newsome (Piper Sander) and Meyer Shields (Keefe, Bruyette & Woods), both of whom have been following Gallagher for 25 years professionally. Other sources include Gallagher’s annual 10-K and DEF 14A SEC filings, the transcript of Gallagher’s Q4 2024 investor earnings call held on January 30, 2025, IBIS World global industry research firm, and Tracxn company data. A full bibliography is included below. Gallagher executives were contacted for this report, but were unable to comment during the firm’s present Q1 2025 quiet period.

Acquisition History and Strategy

Scope, Frequency, and Deal Value

Sector Targets and Business Model Trends

Integration Framework and Execution

The Gallagher Way

Operational Alignment vs. Autonomy

Litigation and Regulatory Exposure

Poaching Disputes and Talent Protection Practices

Micro-Captive Structures and Federal Scrutiny

Revenue Drivers and Capitalization Trends

Fee vs. Commission Income Structure

Borrowing Patterns and Cash Liquidity Trends

Goodwill Accumulation and Asset Distribution

Shareholder Base and Voting Control

Major Investors and Engagement Profiles

Executive and Board Equity Alignment

Expenditure Allocation and Strategic Investment

Tangible vs. Intangible Asset Utilization

Acquisition, Absorption, and Restructuring Spend

Shareholder Returns and Capital Flexibility

Primary Revenue Streams and Client Segments

Brokerage: Scale and Margin Expansion

Risk Management: Client Lifecycle Retention

Upcoming Strategic Shifts and Growth Priorities

International Market Development

Digital Infrastructure and Security Governance

Technology: Proprietary Platforms and Insurtech Partnerships

Cybersecurity: Governance, Risk Protocols, and Third-Party Oversight

Risk Factors

Share Price Strategy and Investor Positioning

Credit Outlook

Leadership Composition and Institutional Ties

Executives

Directors

Decision Leaders

Executive Compensation

Bibliography

ACQUISITION HISTORY AND STRATEGY

While most brokerages cautiously cherry-pick their acquisitions, Gallagher has embarked on a number of acquisitions of unparalleled scope and variety. It’s not just the sheer volume that sets Gallagher apart. The firm’s voracious appetite spans continents, business models, and specialties, from fine art insurance in Zurich to HR consulting in North America and animal health analytics in Australia. With regulatory eyes now focused on its blockbuster $13.45 billion bid for AssuredPartners, Gallagher is testing the limits of scale in an industry built on relationships and local expertise. This is more than just empire-building: the firm’s acquisitions reveal a blueprint for a next-generation brokerage that is digitally savvy, globally diversified, and operationally elastic.

Since its founding in 1927, Gallagher has strategically grown through acquisitions, completing 331 in total. Notably, more than half of these transactions, 178, have occurred since January 2020. Fiscal year 2023 marked Gallagher’s most aggressive year for acquisitions, with 38 deals completed.[1] In comparison, major players such as Aon plc and Marsh & McLennan Companies, Inc. have only completed 41 and 17, respectively, over their entire corporate lifetimes.

Gallagher’s landmark deal for AssuredPartners, a life insurance and risk management provider, announced on December 11, 2024, for $13.45 billion, is still pending finalization as of April 2025.[2] However, Gallagher is facing additional regulatory scrutiny; the US Department of Justice issued a second request for information regarding the deal, likely due to concerns about market share concentration and competition in the US industry.[3]

Gallagher is one of the many private equity-backed insurance companies “buying up” smaller brokerages, said Newsome. “There’s an enormous amount of scale economy that can be achieved in an insurance brokerage. So, it’s a very rapidly consolidating business... (Gallagher) is a little bit more extreme, in the sense that they put more of their cash flow in than others do,” he said.

Several key acquisitions in recent years reflect Gallagher’s broad and diversified expansion strategy. For example, in March 2025, the firm acquired Woodruff Sawyer, a major US insurance brokerage, for $1.2 billion. Similarly, Gallagher’s April 2023 acquisition of Buck (BCHR Holdings, L.P.), a leading HR, pensions, and employee benefits consulting firm, for $660 million expanded the company’s Canada, UK, and US footprint in retirement, benefits, and investment consulting.[6]

In 2021, the firm’s $3.25 billion acquisition of WTW’s reinsurance brokerage, Willis Re, significantly enhanced its global risk and insurance brokerage capabilities. Notably, the acquisition brought new tools for catastrophe modeling, financial analysis, and capital modeling.

“(Willis Re) is more luck than anything else... and that was an important complement to the other brokerage businesses that they own,” said Shields. Newsome said more of Gallagher’s acquisitions were driven by the other’s desire to sell than Gallagher’s desire to buy.

Another strategic acquisition was July 2021’s purchase of India’s Edelweiss Insurance for $41 million, which marked Gallagher’s entry into the South Asian property and casualty brokerage market.[7]

Firms acquired by Gallagher span a wide range of business models. Since 2020, the most common business model was the “diversified” classification, which appeared in 58 percent of acquisitions.

Gallagher’s next most acquired business model was “insurance distribution” (52 percent of acquisitions),[8] which falls into the “benefit administration services” industry classification. That sector has seen modest growth since 2019, with US revenue rising 3 percent to $278 billion and employment increasing 5 percent to 542,000. Forecasts to 2029 project slower gains of 1.2 percent in revenue and 2.8 percent in employment. However, margins have been under pressure: benefit administration profits have declined by 0.6 percentage points since 2019, squeezed in part by inflationary pressures in 2022 that pushed many firms to internalize these services.[9]

Other notable acquired business models include property and casualty insurance firms (13 percent of acquisitions), insurance carriers (12 percent), and HR services (8 percent).[10]

Gallagher has acquired several firms formerly owned by banks and produced outcomes that defy conventional assumptions about the conservatism and inertia of bank-operated insurance units. “Certainly, when we look at the results after Gallagher’s taken ownership of them, there is no impediment to the strong organic (revenue) they’re producing,” said Shields.

Beyond headline deals, Gallagher’s acquisition trail shows a growing interest in niche sectors and technology-driven services. In 2021, it acquired Agersens, a platform focused on animal health monitoring and data analytics. Earlier, in 2019, it added BluePeak Advisors, a medical compliance consulting firm. Kusske Financial and New Zealand’s RMA Financial, both acquired in 2022 and March 2025, respectively, expanded Gallagher’s reach in financial planning and investment advisory services.[11] In May 2023, the firm expanded its European specialty operations with the acquisition of accurART, a Zurich-based fine art insurance broker. That same month, it bought Bernard Benefits and Bernard Healthcare, strengthening its presence in small-group and individual health benefits consulting across Tennessee, Indiana, and Texas.[12]

The year 2023 saw a flurry of Gallagher acquisition activity. It acquired Clements Worldwide, a broker focused on expatriate and mission-driven organizations, and Rosenzweig Insurance Agency, which specializes in pharmacy benefits for small businesses and individuals. It also finalized a $510 million acquisition of Eastern Insurance Group, formerly a division of Eastern Bank, broadening its reach across New England.[13]

A month later, Gallagher completed its $904 million acquisition of Cadence Insurance, formerly a subsidiary of Cadence Bank, significantly enhancing its capabilities in commercial and personal lines, as well as employee benefits across the Southeast and Texas. Additional 2023 acquisitions included Hughes Insurance Agency and The Evans Agency in upstate New York and Hunt Insurance Group, a Chicagoland-based brokerage with expertise in labor union benefit programs.[14]

Taken together, these acquisitions paint a picture of a firm no longer content to remain a traditional brokerage. Gallagher has systematically broadened its capabilities across geographies, industries, and service lines, often with a technological or niche-market angle. While its foundation remains in insurance brokerage and risk management, its expanding portfolio now touches human resources, healthcare consulting, financial advisory, and specialty insurance. Whether this ambitious diversification leads to long-term strategic advantage or invites operational complexity remains to be seen. For now, Gallagher’s growth-by-acquisition strategy shows no sign of slowing.

INTEGRATION FRAMEWORK AND EXECUTION

Gallagher imposes an unusual degree of operational and cultural integration. It aligns systems, protocols, and ethos captured in its internal playbook, The Gallagher Way. From boutique HR consultancies to global reinsurance units, each Gallagher acquisition is absorbed into a centralized framework, with a blend of unity and flexibility that has enabled the firm to scale aggressively without becoming structurally incoherent.

While its acquisition behavior is not unprecedented, where Gallagher’s strategy is unique is concerned with the fact that they wrote the book on insurance firm acquisitions, said Newsome. The Gallagher Way: A Corporate History of Arthur J. Gallagher & Co., written by journalist Alison Kittrell and published in 2005, charts the firm’s evolution from its 1927 founding by Arthur James Gallagher to its current status as a global brokerage powerhouse. The book underscores a long-standing emphasis on value-driven integration rooted in professional excellence, teamwork, trust, and respect as the cultural foundation of the firm’s M&A playbook.[15]

The firm’s “entrepreneurial, go-getter style” imposition across its acquisitions speaks to its decade-old growth strategy, said Sarah Lyons in a 2018 interview with Insurance Business Australia. In 2014, Gallagher acquired Lyons’s OAMPS Insurance Brokers in Australia. This transitioned Lyons to the chief executive of Gallagher’s Australian operations. “Although (Gallagher's) current headcount sits at around 25,000 colleagues globally, we haven’t lost sight of the family culture that makes us what we are today. Culturally, I think that sets a positive tone for the way we work together and do business,” she said. [16]

Acquisitions are not merely about growth, but about capability enhancement and cultural alignment. What sets Gallagher apart, said Newsome, is its commitment to operational cohesion. Opposed to leaving acquired businesses intact or technology adapted, “Gallagher tends to make acquisitions and roll everybody over into their systems and processes. These businesses, to a certain extent, remain independent, especially on the producer level. But Gallagher is known in the industry for making changes to companies that they acquire.”

That balancing act of centralized integration without suffocating autonomy has become a defining feature of Gallagher’s M&A identity. Producer-level independence is preserved, maintaining client continuity and entrepreneurial energy. But back-office systems, compliance protocols, and IT infrastructure are swiftly aligned with Gallagher’s broader enterprise platform.

Shields echoed Newsome’s assessment of Gallagher’s disciplined post-acquisition approach. “Their execution has been phenomenal,” he said.

Gallagher’s post-M&A strategy is a study in structured integration. It’s not simply a matter of buying growth, but of imposing coherence through culture, systems, and standards. The firm’s ability to maintain a unified operational backbone while preserving local producer autonomy helps explain its success in folding in hundreds of acquisitions without unraveling. In an industry where integration missteps can erode value as quickly as deals are signed, Gallagher’s methodical approach has become something of a case study in how to scale without losing identity.

LITIGATION AND REGULATORY EXPOSURE

As Gallagher continues to expand its footprint across markets and business lines, its assertive approach has drawn increasing legal and regulatory attention. Its retention practices have generated the most consistent friction, frequently leading to litigation with competitors over alleged contract breaches and employee poaching. These cases, while not uncommon in the industry, reflect Gallagher’s willingness to operate near the boundaries of competitive conduct.

Shields noted the firm’s exposure to tremendous amounts of litigation tied to hiring activity. “There have been examples that have been more aggressive in recruiting and potentially crossing lines,” he said.

For instance, in 2019, the firm sued UK-based Ardonagh Group for allegedly orchestrating a mass defection of six employees, which courts ultimately dismissed due to a lack of evidence.[17] In the US, Gallagher brought multiple lawsuits against Alliant Insurance Services, accusing it of poaching employees and clients through coordinated raids, including a 2020 case involving ten staff resignations[18] and a separate $900,000 settlement over a former employee violating non-solicitation agreements.[19] Alliant has countered these claims by accusing Gallagher of weaponizing litigation to intimidate employees and suppress competition, framing the lawsuits as heavy-handed attempts to discourage staff from seeking better opportunities.[20]

A notable and ongoing issue is Gallagher’s involvement in the Internal Revenue Service’s investigation into its advisory services related to IRC 831(b) “micro-captive” insurance arrangements. Under scrutiny since 2013, the IRS is examining whether Gallagher’s activities in this area constitute the promotion of abusive tax shelters. While a separate criminal investigation into micro-captive underwriting is also underway, Gallagher has been informed that it is not a direct target of the probe. The firm continues to cooperate fully with the IRS and maintains that these investigations will not result in any long-term operational or reputational damage.[21] Nonetheless, the company remains under a regulatory microscope, at least in this segment of its business.

Gallagher’s entanglements with the IRS and frequent litigation over recruitment reflect the tension between ambitious strategy and regulatory boundaries. These issues, while not existential, are not without consequence. The firm’s continued ability to manage reputational risk and navigate compliance obligations will be key as it pushes further into contested spaces, whether that means tax-advantaged structures or fiercely competitive hiring grounds.

REVENUE DRIVERS AND CAPITALIZATION TRENDS

Gallagher’s financial profile reflects the operational intensity of a firm built around acquisitions. Between 2020 and 2024, it more than doubled its revenue and nearly tripled its asset base, driven by consistent deal-making and steady revenue-share growth of commissions and fees. At the same time, the company’s debt levels, liquidity, and goodwill have shifted significantly, following hallmarks of an organization deploying capital at scale to fund expansion. Unlike peers balancing shareholder returns and organic investment, Gallagher has maintained a singular focus on acquisition-led growth. While this strategy has delivered results, its success increasingly hinges on the firm’s ability to manage leverage, integrate acquired assets efficiently, and sustain value creation across a growing, more complex balance sheet.

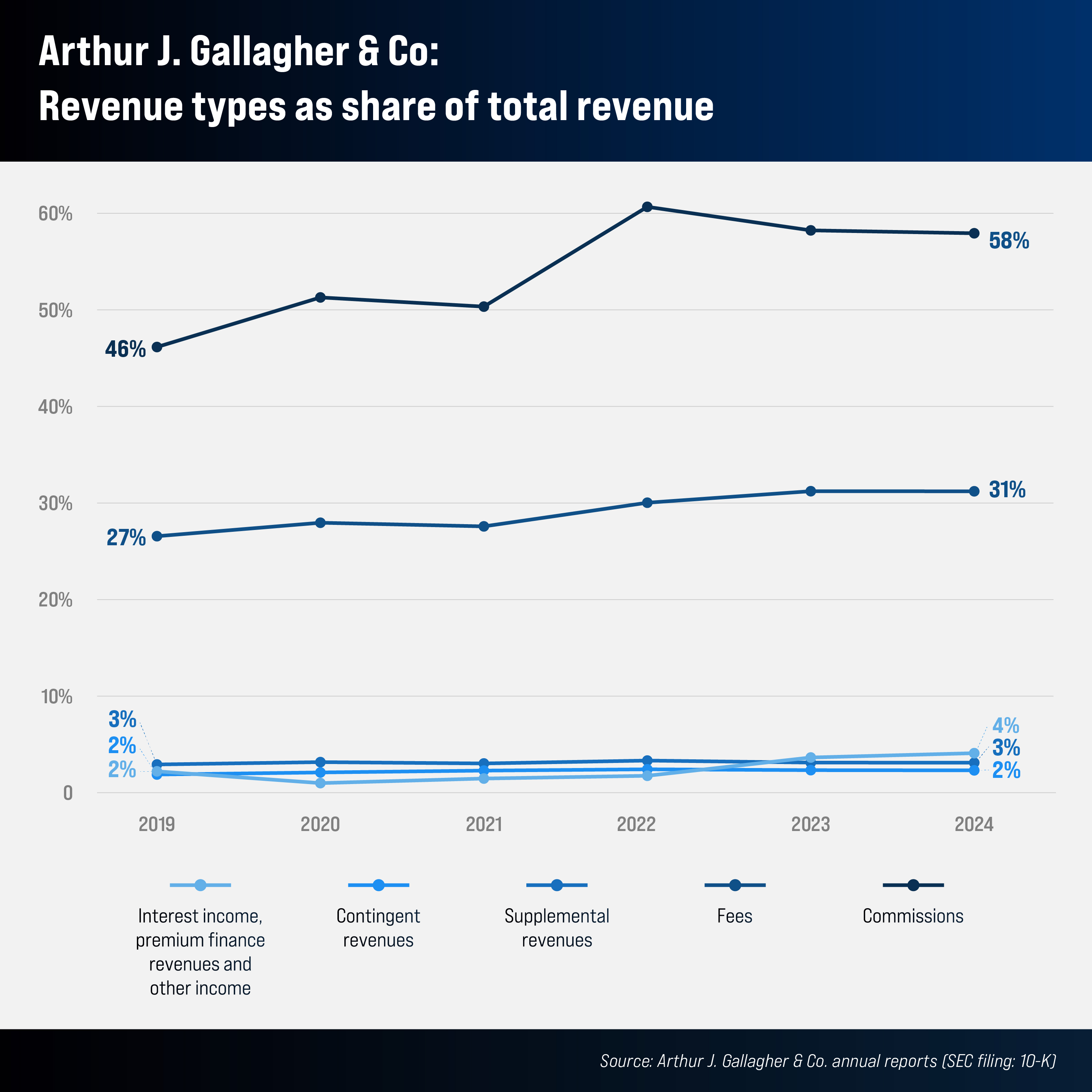

Commissions and fees have consistently dominated Gallagher’s revenue mix. In 2024, they accounted for 89 percent of total revenue, or $10.3 billion, split between 58 percent from commissions and 31 percent from fees.[22] This marks a clear rise from 2020, when these sources represented 79 percent of total revenue, or $6.3 billion (with 51 percent from commissions and 27 percent from fees).[23] Commissions are typically pegged to premium volumes or client headcounts and are sensitive to factors like risk type, insurer appetite, and placement complexity. Fees, by contrast, are tied to the anticipated service effort and delivered incrementally, making timing and scope crucial to revenue recognition.

Revenue linked to clean coal activities, such as commissions and service fees for clients in the sector, has dropped precipitously. In 2019 and 2021, this segment represented 18 percent ($1.3 billion) and 13 percent ($1.1 billion) of total revenues, respectively.[24] But by 2022, it had fallen to less than 1 percent, totaling just $23 million, and was ultimately excluded from subsequent annual reports. Despite this decline, Gallagher’s total revenues grew by $4.5 billion between 2020 and 2024. From 2022 to 2024 alone, commissions rose by $1.5 billion, fees by $1 billion, and interest income by $323 million.[25]

Borrowings rose significantly in 2024, with total corporate debt increasing 68 percent year over year from $7.6 billion in 2023 to $12.9 billion. Interest expenses tracked upward accordingly, reaching $381.3 million in 2024, up from $196.4 million in 2020, and with a 28 percent year-over-year increase from 2023. The increase in leverage is widely attributed to the financing of major acquisitions, notably that of AssuredPartners. Still, current borrowings (debt due within 12 months) fell to their lowest share since 2020; just 1.5 percent, or $200 million, of total borrowings in 2024. This marked a stark contrast from the prior year, when current borrowings spiked to 8 percent of the total ($670 million), up from $310 million in 2022.[26]

Total assets reached $64.2 billion in 2024, up from $22 billion in 2020. The company’s assets have grown by at least $11 billion annually, with the exception of 2022, when the increase was just $5 billion. A significant portion is fiduciary assets representing client funds, insurance premiums, and third-party arrangements, which amounted to $24.7 billion in 2024. While the firm may earn limited interest income on certain fiduciary assets – invested conservatively in cash and US Treasury instruments per regulatory constraints – many jurisdictions impose strict controls on fund use, investment, and liquidity.

Additionally, goodwill – the reflection of the firm’s acquisition value, brand strength, and future earnings potential – stood at $12.2 billion. Together, Gallagher’s fiduciary and goodwill make up 57 percent of its total assets.[27]

Cash and cash equivalents saw a dramatic jump in 2024, totaling 23 percent, or $14.9 billion of total assets. In 2023, cash assets were valued at just $971 million. This sharp increase is a significant shift in Gallagher’s liquidity position.[28] However, $13.5 billion will be used to fund Gallagher’s acquisition of AssuredPartners, according to Howell.[29]

“They’ve basically put virtually all of their cash flow into making acquisitions over a very long period of time,” said Newsome. Unlike other brokerages’ balanced approach to acquisitions, stock repurchases, and dividends, Gallagher is primarily focused on making acquisitions year in and year out. “Regardless of the competitive environment or who they’re competing against, they have just been an absolute (acquisition) vacuum for a very long time,” he said.

Taken together, Gallagher’s financial profile reveals a company scaling rapidly through acquisition, heavily reliant on commissions, and increasingly leveraged to fuel its expansion. While the firm’s margin growth and revenue gains are striking, rising debt and a concentrated financial strategy may pose headwinds should market conditions tighten or acquisition returns falter.

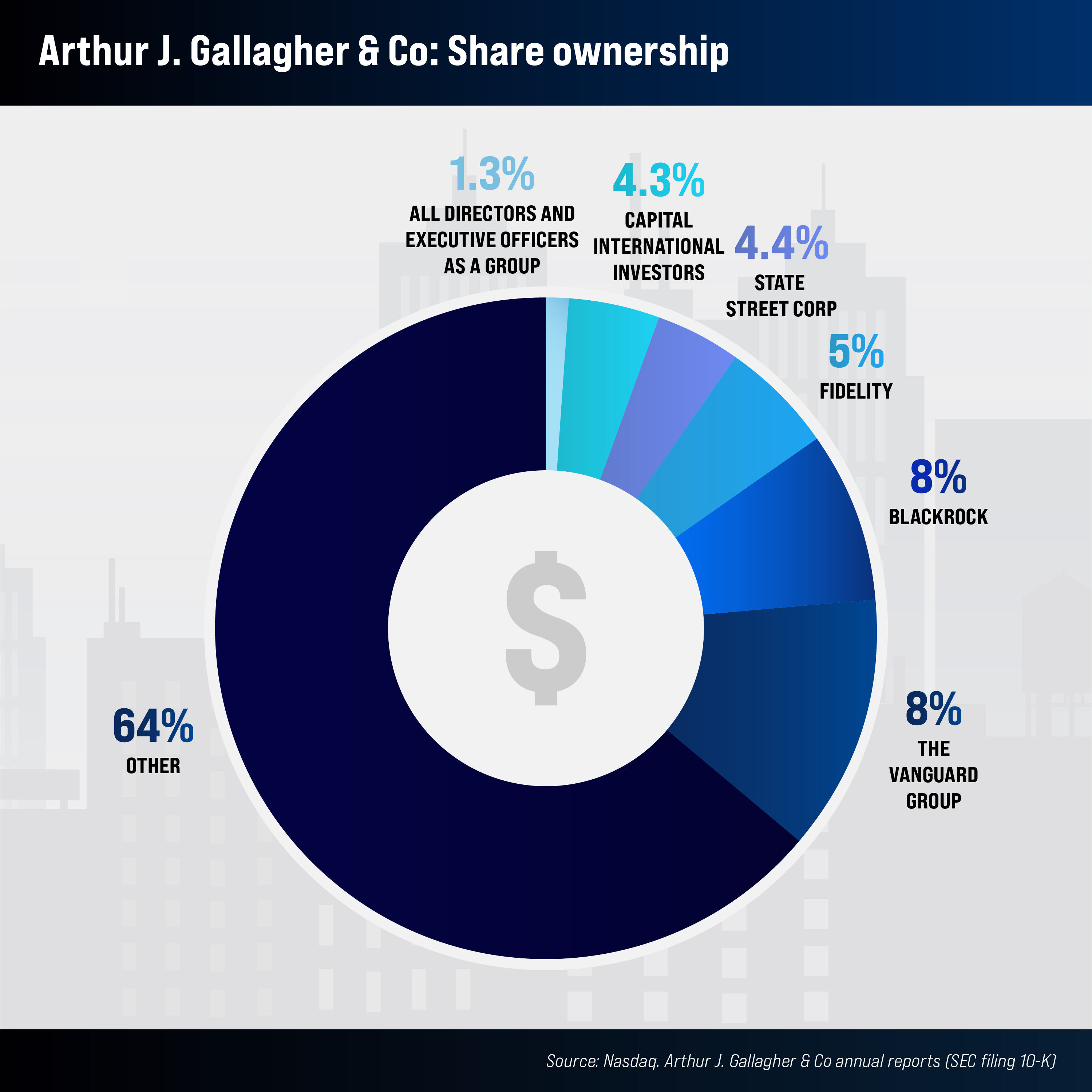

SHAREHOLDER BASE AND VOTING CONTROL

Institutional dominance in Gallagher’s common stock reflects not only broad shareholder confidence but also a governance model that prioritizes performance, risk discipline, and long-term value creation. With firms like Vanguard and BlackRock holding significant decision-making stakes, Gallagher operates within an arrangement that underscores the professionalized, investor-led nature of the business. While insiders hold a relatively small equity share, the structure aligns Gallagher’s leadership closely with shareholder interests, particularly as it continues to pursue acquisition-led growth under constant investor scrutiny.

As of March 17, 2025, The Vanguard Group held the largest stake: 10 percent of Gallagher’s common stock, equivalent to 25.5 million shares. BlackRock, Inc. followed with a 6.8 percent stake, or 17.4 million shares.[30]

Vanguard’s presence is notable not only for its size, but also for its philosophy. The firm is widely known for advocating robust corporate governance practices across its portfolio, often engaging directly with companies to ensure alignment with shareholder interests. Traditionally associated with passive index investing, Vanguard has recently branched into active management and financial advisory services. Through partnerships with firms like Wellington Management Company LLP, it now holds actively managed portfolios that include insurance industry players such as Gallagher. The recent addition of industry veteran Joanna Rotenberg to Vanguard’s wealth management leadership hints at a broader strategic push that could potentially intersect with Gallagher’s product offerings in the insurance advisory space.[31]

Other major institutional shareholders reinforce a pragmatic ownership approach. As of December 31, 2024, notable shareholding firms included J.P. Morgan Chase & Co. (with 12.5 million or approximately 4.9 percent of shares), Fidelity Investments (11.9 million shares, 4.7 percent), State Street Corporation (10.2 million shares, 4 percent), and Capital International Investors (10 million shares, 3.9 percent).[32]

Each firm brings its own style of engagement. J.P. Morgan and State Street are known for selectively engaging in matters tied to financial performance and long-term risk stability.[33],[34] Fidelity, with its track record of value investing, typically targets companies with strong earnings upside and underappreciated fundamentals.[35] Meanwhile, Capital International Investors is distinguished by its research-driven strategy and willingness to push for disciplined M&A execution and enhanced risk oversight.[36]

On the internal ownership front, Gallagher’s directors and executive officers collectively hold 2.7 million shares or just 1.3 percent of the company’s outstanding stock.[37] This comparatively low insider stake reflects the firm’s lack of strong founder influence and underscores the institutional tilt of its governance structure.

With institutional investors driving much of Gallagher’s strategy and governance, the firm's future will likely continue to be influenced by a select group of financial powerhouses. Their focus on financial performance, risk management, and corporate governance will remain central to shaping Gallagher’s long-term success in an increasingly competitive market.

EXPENDITURE ALLOCATION AND STRATEGIC INVESTMENT

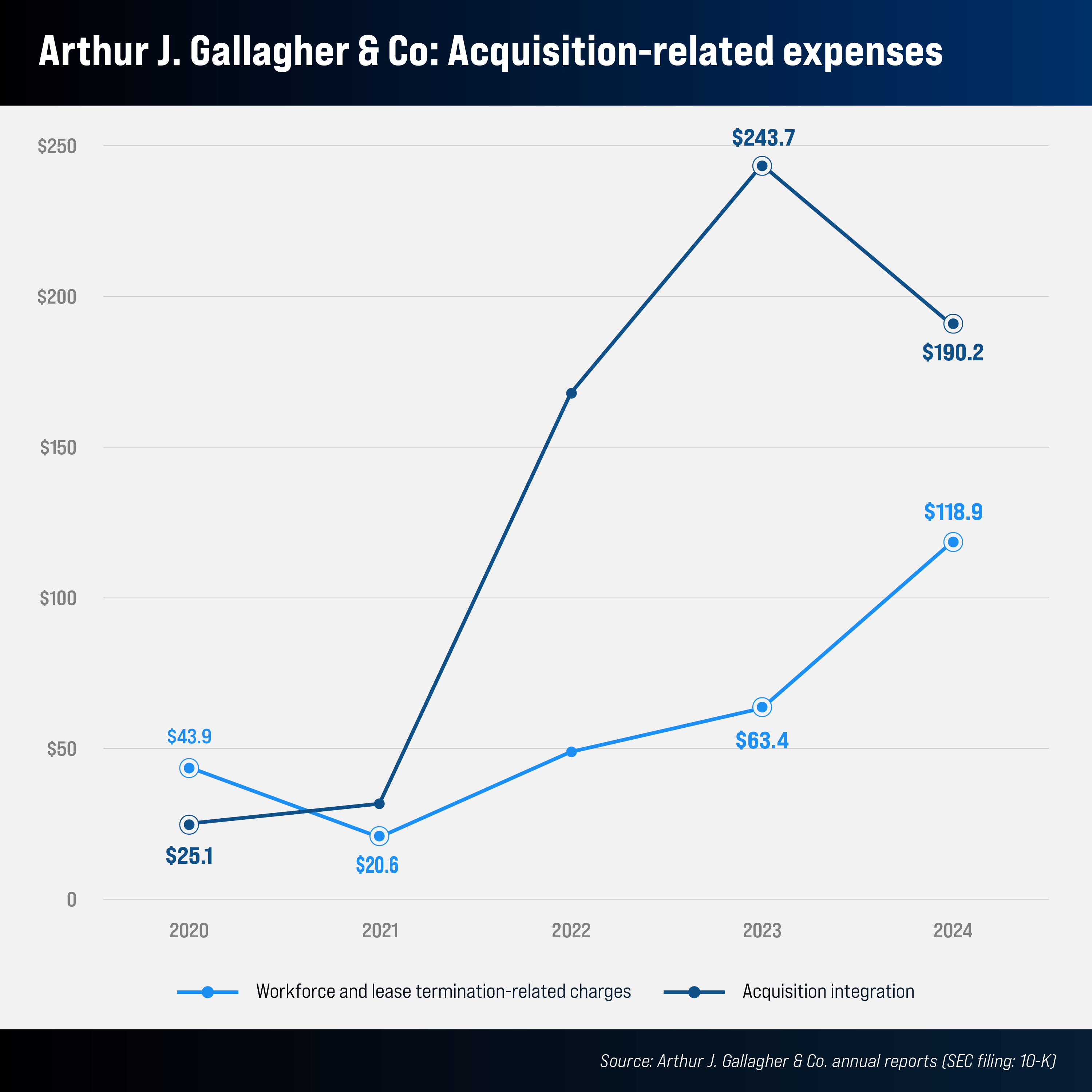

In a sector where organic growth can feel like a slow burn, Gallagher has doubled down on a more assertive formula: buy, build, and integrate fast. Behind the firm’s disciplined capital strategy is a sharp tilt toward intangible asset investment, as evidenced by a 56 percent surge in amortization costs since 2020. While the depreciation value of physical assets has crept upward, the real action is in the acquisition of customer relationships, brand equity, and software; the hidden scaffolding of modern insurance services. Further, acquisition integration spending has exploded more than sixfold during a deliberate pullback on traditional capex and careful liquidity management. In doing so, it isn’t just about acquiring firms. Its absorbing capabilities, recalibrating infrastructure, and laying the groundwork for sustained competitive advantage in a consolidating global market.

Between 2020 and 2024, Gallagher's total expenses grew by 57 percent, reaching $9.68 billion in 2024. Among these expenses, compensation has steadily risen, becoming an increasingly dominant part of the company’s cost structure.[38] In 2020, compensation – encompassing salaries, employee-related costs, and executive compensation – accounted for 50 percent of total expenses, or $3.3 billion.[39] By 2024, this share grew to 67 percent, amounting to $6.5 billion. This shift has somewhat stymied the expense share of other investment-related costs, such as operating expenses, signaling Gallagher’s increasing focus on its workforce, recruitment, and human resources as a core driver of value.

Meanwhile, Gallagher’s amortization and depreciation trends reflect its growing capital investments. Since 2020, depreciation – the value of the company’s tangible assets, such as cash, property, or inventory over the span of its useful life – rose 26 percent to $177 million. Amortization of intangible assets like software, licenses, and goodwill, however, saw a dramatic 56 percent increase from 2020, reaching $664 million in 2024. This surge primarily reflects Gallagher’s aggressive expansion strategy, which has heavily relied on acquisitions, particularly intangible assets like goodwill and customer relationships. This focus on intangible assets underscores Gallagher’s approach to long-term growth through strategic acquisitions that enhance its market position.[40]

One of the most telling aspects of Gallagher’s reinvestment approach is its escalating investment in acquisition integration. Between 2020 and 2024, acquisition integration skyrocketed by 657 percent, leaping from $25 million to $190 million[41],[42]. This trend continued between 2023 and 2024, with restructuring-related costs, including workforce and lease termination fees, climbing 87 percent.[43],[44] These figures speak to the company’s commitment not only to acquiring businesses but also to efficiently integrating and optimizing them within Gallagher’s broader operational ecosystem.

In terms of capital expenditures, in 2024, Gallagher allocated $141.9 million, a decrease from 2023’s $193.6 million. These expenditures were largely devoted to office relocations, IT upgrades, and software development. The firm also benefited from substantial property tax-related credits and an Illinois state tax credit, potentially totaling between $50 million and $80 million over the next 15 years. Looking ahead, the company expects capital expenditures to rise to $150 million in 2025, driven by similar investments and acquisitions completed through December 2024.[45]

As for capital returns, Gallagher follows a disciplined dividend policy. In 2024, the company declared $529.9 million in dividends on common stock, reflecting a consistent commitment to returning capital to shareholders. The quarterly dividends are evaluated based on cash availability, future needs, and market conditions. Although the firm hasn’t repurchased shares in recent years, it has a $1.5 billion stock repurchase plan in place, offering a potential avenue for further capital return if cash flows exceed acquisition opportunities.[46]

Looking forward, Gallagher remains focused on growth through both organic expansion and strategic acquisitions. Proceeds from its capital-raising activities, such as stock offerings and the credit facility, will be deployed toward acquisitions, earnout payments, and general corporate purposes. By maintaining liquidity and leveraging flexible financing structures, Gallagher is positioning itself for continued expansion in the insurance and risk management sectors, setting the stage for sustained long-term growth.

PRIMARY REVENUE STREAMS AND CLIENT SEGMENTS

In a consolidating brokerage landscape shaped by rising premiums and shifting client expectations, Arthur J. Gallagher & Co. has leaned heavily on its core brokerage business, accounting for 86 percent of 2024’s total income, to drive growth. The firm’s revenue expansion reflects both the structural tailwinds of a hardening insurance market and the operational leverage of a business model increasingly built around scale, client lifecycles, and specialization. Notably, Gallagher’s profit margins have widened to 20 percent, suggesting improved efficiency amid broader industry cost pressures. While future gains may hinge on continued acquisition and integration efforts, as well as steady organic growth, Gallagher’s performance highlights the evolving dynamics of broking, where diversification, client retention, and margin discipline are becoming as critical as volume.

In 2024, Gallagher recorded revenues of $11.5 billion – a doubling of 114 percent over its 2015 figure of $5.3 billion. Much of this growth has occurred in the post-2020 period, with particularly strong momentum beginning in 2021. The most substantial year-over-year gain came between 2022 and 2023, with revenue rising 18 percent.

Gallagher operates across three business segments: brokerage, risk management, and corporate services. The primary business is brokerage. In 2024, it contributed 86 percent of total revenues and alone generated $9.93 billion, a 15 percent rise from the $8.63 billion achieved in 2023[47]. Risk management accounts for 14 percent of revenues, while corporate services generate only a modest share.[48]

The company now ranks as the second-largest insurance brokerage in the US, holding 4.4 percent of market share, a position it shares with Marsh & McLennan Companies. Market leader Aon plc commands a 6.9 percent share.[49]

Gallagher’s brokerage segment anticipates 6 percent to 8 percent organic growth for 2025, in line with last October’s guidance, according to the firm’s 2024 Q4 earnings call. According to CFO Douglas Howell, roughly 50 percent of growth will come from net new business, with 25 percent each from rate increases and exposure growth. Notably, this projection excludes any potential tailwinds from casualty reserve strengthening or wildfire-driven premium hikes.[50]

Diversity has helped insulate the firm from sector-specific volatility. The brokerage arm offers a wide-ranging portfolio: insurance and reinsurance, employee benefits programs, and risk consulting. Clients span commercial firms, nonprofit organizations, public entities, other insurers, and a small individual client base.[51]

A broad hardening of the US insurance market, driven in part by natural disasters, has supported Gallagher’s performance. Premium increases, particularly in health and property insurance, have bolstered US broker revenue, and further margin expansion appears likely for the sector. Since 2019, total US insurance brokerage revenue has grown by 1.1 percent to $216.4 billion, while employment and the number of active firms have also edged up slightly.[52]

Lyons said that the previously extended soft market may have created a sense of security for some brokers. “But the current market cycle is where the value of a good broker really comes to the fore. In that respect, I think Gallagher is well positioned to respond,” she said.

Looking ahead to 2029, US brokerage revenue is projected to grow by a further 1 percent. Although they offer modest acceleration, the factors of easing inflation, improving consumer sentiment, and rising per capita disposable income are expected to be key contributors.[53]

Within Gallagher’s brokerage segment, retail insurance accounts for 73 percent of revenues. The company places nearly all lines of commercial insurance, from property and casualty to life, health, welfare, and disability coverage. Its annual report highlights 32 key insurance lines, including cyber liability, directors’ and officers’ liability, errors and omissions, and workers’ compensation. It also targets a broad range of niche industry verticals, from healthcare and financial services to education, construction, energy, and life sciences.[54]

The remaining 27 percent of brokerage revenue is split between global reinsurance (13 percent) and wholesale brokerage (14 percent).[55] Gallagher Re, the firm’s reinsurance arm, has weathered recent seasonal softening in pricing by expanding its client base, buoyed by its acquisition of WTW’s reinsurance operations.[56] The wholesale business, meanwhile, supports both Gallagher’s own retail brokers and unaffiliated third-party brokers, who contribute 75 percent of wholesale revenue.[57] The wholesale unit specializes in placing complex or hard-to-insure risks.

Gallagher’s risk management segment, led by Gallagher Bassett, contributed $1.6 billion in 2024 and accounted for 14 percent of company-wide revenues.[58] Its revenues were up from $1.43 billion in 2023.[59] While smaller in scale, this segment plays a pivotal strategic role by enhancing client retention and offering long-term value.

Gallagher Bassett focuses on claims settlement and administration, loss control, and consulting, primarily for Fortune 1000 firms, large middle-market businesses, public sector entities, and self-insured organizations.[60] According to Shields, this capability helps retain clients as they scale and transition to self-insurance models, particularly in lines such as workers’ compensation, where recurring and predictable losses, up to millions annually, make self-insurance cost-effective.

“By having that capability for its clients to get bigger and bigger, and to stay with Gallagher as they get bigger, extends the lifecycle of companies staying with Gallagher. That would be something I certainly highlight,” said Shields.

Though barriers to entry into risk management have declined thanks to remote work models and cloud-based platforms, intensifying competition has led to fewer small players and a spate of acquisitions. Gallagher’s acquisition-heavy growth strategy has served it well in this environment. Nonetheless, Marsh & McLennan leads US risk management with $1.7 billion in US revenue and a 14 percent market share, followed by WTW ($896.9 million, 8 percent) and Aon plc ($652.4 million, 5.8 percent). Between 2019 and 2024, total US risk management revenue grew 4.6 percent to $11.3 billion. However, the number of US businesses shrank by 1.4 percent, while employment rose only 0.4 percent to 52,754.[61]

Within Gallagher’s risk management business, workers’ compensation holds the majority, 61 percent of revenue, followed by auto liability (34 percent) and property claims (5 percent), in a structure unchanged since at least 2019.[62],[63] Although US workplace safety improvements are expected to dampen overall claims volume, they are also likely to reduce operating costs, making workers’ compensation one of the industry’s most profitable segments.[64]

Between 2015 and 2024, Gallagher’s net profits rose a striking 667 percent from $293 million to $2.28 billion. Importantly, this profitability trend has kept pace with revenue growth, indicating a scalable business model that has absorbed expansion without disproportionate cost inflation.

In 2024, Gallagher reported a 20 percent profit margin, up from 18 percent in 2023 and well above the 11.8 percent average margin between 2015 and 2024. This margin expansion underscores the company’s operational efficiency and profitability, even amid industry-wide contraction and cost discipline.

Gallagher continues to build its market position through a blend of disciplined execution and targeted innovation. Its brokerage business remains the cornerstone of financial performance, while the risk management segment extends its client value proposition in a way few competitors match. As the firm looks to 2025 and beyond, its organic growth ambitions appear grounded not in speculative tailwinds but in the fundamentals of a model that has proven both profitable and resilient.

UPCOMING STRATEGIC SHIFTS AND GROWTH PRIORITIES

As the insurance industry contends with tightening capital, rising loss costs, and a growing appetite for bespoke risk solutions, Gallagher appears to be aligning its strategy with the shifting center of gravity. The firm’s focus is on the middle market, which was long overshadowed by large-account competition but is now a faster-growing and more complex segment. Growth plans hinge on expanding reinsurance offerings, scaling program business, and deepening exposure to alternative risk vehicles such as captives and self-insurance. While acquisitions remain central to Gallagher’s playbook, the firm’s ability to adapt its service mix to client preferences may define its trajectory over the next cycle.

In retail brokerage, Gallagher sees the greatest growth opportunity in the middle market and niche sectors. Central to Gallagher’s future revenue ambitions are these clients with their complex insurance needs spanning property, liability, workers’ compensation, and employee benefits.[65]

The middle market is a mainstay for the broader insurance industry, although its revenue generation compared to the large-account business has tradeoffs. “The large account business is highly profitable, but it doesn’t grow very fast. Gallagher’s inherited this middle-market position, and the middle market grows faster than the large accounts,” said Newsome.

Meanwhile, increasing demand for bespoke solutions is pushing the firm to innovate in alternative markets, such as captives, rent-a-captives, and deductible/self-insurance plans. These vehicles are expected to gain traction as clients seek greater flexibility and control over their risk financing.[66]

Gallagher Re, the firm’s global reinsurance division, has set its sights on expanding both its client base and its service offerings by targeting underwriting enterprises. Gallagher Re is investing in product development and building out its facultative reinsurance capabilities, which provide more tailored risk solutions. Acquisitions remain a key lever here, too, offering a fast track to enhanced capabilities, geographic reach, and market share.[67]

In the risk management segment, Gallagher identified outsourcing as a major growth trend, with insurers and self-insured entities increasingly turning to third-party administrators to manage claims and streamline operations. Gallagher expects to benefit as this trend accelerates, particularly among Fortune 1000 firms and large middle-market companies. Captive insurance programs are also forecast to grow, offering Gallagher opportunities to serve clients who want to retain more control over their own risks while still accessing Gallagher’s scale and expertise.[68]

Program business – where underwriting, distribution, and claims management are bundled for specific markets – is another focus. This model is gaining traction in industries with specialized risk profiles, providing Gallagher with a path to scalable and high-margin growth.[69]

Gallagher anticipates further tightening in property pricing at renewal, especially in reinsurance, as 2024’s insured global catastrophe losses are estimated at $150 billion, first-quarter 2025 losses were potentially magnified by events like the California wildfires, and social inflation heightens. These shifts present both risk and opportunity, depending on how effectively carriers and brokers can respond.[70]

Casualty lines may face a more challenging environment if loss trends worsen or if profitability deteriorates. In its recent annual report, Gallagher acknowledged this risk but expressed confidence in its ability to maintain growth through strong client retention, new business generation, and differentiated service offerings.[71]

Gallagher’s strategic path is not speculative, but grounded in deliberate moves across multiple fronts. By focusing on its strengths in the middle market, enhancing specialty capabilities, and doubling down on acquisitions and innovation, the firm is positioning itself to thrive in a complex and capital-constrained market. Its outlook remains bullish, anchored by proven growth drivers and a firm grasp on industry headwinds.

INTERNATIONAL MARKET DEVELOPMENT

Gallagher’s global ambitions are taking shape through a deliberate mix of adjacency, acquisition, and operational leverage. While the US remains its revenue cornerstone, the firm is now structuring its international push around a hub-and-spoke model that extends reach from familiar strongholds into adjacent, often underpenetrated markets. With scale in English-speaking countries and a deepening offshore infrastructure in India, Gallagher has positioned itself as the new third pillar among the world’s largest insurance brokerages. The strategy appears less about headline-making entry into emerging economies and more about building out scalable, regional platforms that can serve increasingly globalized middle-market clients.

The US market continues to be Gallagher’s foundation, contributing 64 percent of 2024’s total revenues through its network of 580 sales and service offices.[72] The remaining 36 percent, sourced from 350 offices worldwide, is increasingly significant. This global footprint includes operations in the UK (100 offices), Australia (45), Canada (42), New Zealand (37), with further presence in over 60 countries.[73]

In Q4 2024, Gallagher’s brokerage segment recorded high single-digit revenue growth in the UK, Australia, and New Zealand. US retail organic revenue rose approximately 5 percent, while Canada experienced a slight decline, largely attributed to lower contingent commissions.[74]

Considering Gallagher’s activity in Australia from 2014 to 2018, “it’s incredible to think how much we’ve grown and changed in a relatively short timescale,” said Lyons.

Acquisitions remain central to Gallagher’s expansion efforts, especially as a means of developing a global posture. “In some bursts of activity, as opposed to a little bit every year, they’ve established an international infrastructure starting with English-speaking countries,” said Shields.

From these base markets, Gallagher is executing a classic hub-and-spoke model: launching into Latin America via the US, Western Europe from the UK, and Asia through Australia and New Zealand. The strategy is one of adjacency and leverage, with new regions reached from strongholds already familiar with local regulatory and risk environments.[75]

“By having brokerages on the ground in Australia or England, they can use that more global perspective to appeal to a wider array of clients... There are certainly efficiencies to brokers that can understand your individual risks on a global basis and deal with insurance needs that way,” said Shields.

The firm’s Australian presence is developing a reputation as a specialty broker, including transportation, logistics, and construction. “We have more than three decades of experience to bring to the conversation and a team who have grown with the industry. That’s a significant value-add for clients in Australia,” said Lyons. In 2010, Gallagher’s total Australian employees numbered 80 within a local unit. In 2018, they numbered over 900, mainly as a result of acquisitions.

“Our focus remains on delivering a high-quality experience to clients, backed by a team that is recognized as being the best in the market. When we achieve our aspiration (as Australia’s largest and most admired insurance broker), I want it to be because we have achieved success and recognition on our own terms,” she continued.

Looking forward, Shields expects Gallagher to pursue middle-market opportunities in developing regions, including Africa and Eastern Europe. The groundwork for this is already visible in India, where the firm employs 12,000 staff in its Centre of Excellence office. These employees handle a range of time-intensive back-office functions, from policy processing to data reconciliation between brokers and carriers.[76]

According to Newsome, this office performs remarkably time-consuming tasks that many insurance agents and brokers struggle to manage domestically. During Gallagher’s Q4 earnings call, Patrick Gallagher noted that the firm’s acquisition of AssuredPartners, coupled with continued organic growth, would likely require the Indian office operation to expand by several thousand more employees.[77]

Largely through their pace of acquisitions, intelligent market entry strategy, and operational leverage via global support centers, since 2018 Gallagher has intelligently set themselves up as a cornerstone global brokerage alongside Marsh & Mclennan Companies, Aon and WTW, said Shields.

DIGITAL INFRASTRUCTURE AND SECURITY GOVERNANCE

Gallagher is investing in technologies that can scale operations and support increasingly data-driven client needs. The firm’s focus lies more in back-end efficiency and analytics than in front-end disruption, with proprietary AI platforms like GAIA and Gallagher Drive driving internal productivity and risk modeling. Yet Gallagher’s leadership is also aware of the risks: not only from cyber threats, but also from the rapid pace of innovation that could leave slower-moving incumbents behind. Against this backdrop, the company’s dual focus on proprietary development and selective partnerships with insurtech providers appears aimed at balancing operational control with technological agility.

Gallagher’s use of technology is evident in its operational performance, particularly during the COVID-19 pandemic. According to Shields, the firm’s success in maintaining operational efficiency throughout the crisis resulted in a significant increase in margins. This shift was likely driven by a reduction in redundant expenses, replaced by technology-enabled solutions that streamlined operations and boosted profitability.

As the insurance landscape evolves, Gallagher faces increasing competitive pressure from both traditional market players and emerging insurance technology (insurtech) start-ups. These new entrants are focused on leveraging technology to disrupt established business models and enhance the client experience through innovation. The firm has likewise acknowledged the speed of obsolescence and being behind the curve of competitors as a technology development risk.[78]

“We are being careful not to jump onto the latest gadgets and gizmos, more to properly assess what makes a difference and creates value first, and then understand where technology can respond to that need,” said Lyons from Australia in 2018.

Aware of the competitive challenges, Gallagher has committed to developing and integrating technology solutions that address client needs, align with industry trends, and enhance its internal capabilities. AI training programs were undertaken by over half of those who responded to the firm’s internal 2025 AI benchmarking survey, while 36 percent plan to implement AI upskilling shortly.[79]

Gallagher has two proprietary platforms at the heart of their AI capabilities: Gallagher Automated Insurance Analytics (GAIA) and Gallagher Drive. The first, GAIA, was developed in 2021 by Gallagher Re reinsurance firm, using machine learning and multi-model APIs. As a centralized cloud-based analytics platform, GAIA automates pricing workflows, portfolio optimization, and client reporting, reportedly cutting delivery times by 80 percent.[80] The second, Gallagher Drive, is an in-house hub for advanced data visualization and risk intelligence for the purpose of predictive modeling, fraud detection, claims scoring, and benchmarking.[81] It’s meant for clients to better manage costs and understand emergent risks in real-time.

AI is used throughout Gallagher’s operational structure to support a range of services. AI assists the firm in evaluating historical claims, external factors, and market dynamics. It also uses natural language processing and machine learning to streamline claims assessments through triage, categorization, and recommended compensation.[82]

Outside of the firm, Gallagher has partnered with several prominent insurtech providers. They include SEND, an underwriting administration platform; Federato, an underwriting decision intelligence provider; ProNavigator, an AI-powered document and intelligence management; and Shift Technologies and Sprout.ai, two firms that enable faster claim automation and fraud detection.[83]

Administratively, for years, Salesforce has been the firm’s customer relationship management service across its primary and acquired businesses.[84] Gallagher uses Oracle Cloud Infrastructure, Oracle Autonomous Database, and Microsoft Azure for on-premises business intelligence storage. Oracle Cloud HMC is also employed for human capital management, including absence management, benefits administration, and employee compensation.[85]

Newsome countered the notion that Gallagher is particularly concerned with front-end or client-facing technology development. Commercial insurance brokerages are notoriously old-fashioned on that front, he said. “I don’t think there’s really anybody doing anything particularly different in that regard... I think the biggest difference is you don't hear about the disparate systems that don’t work with each other at Gallagher, whereas you do at some of the other brokers.”

As part of its broader technology strategy, Gallagher has placed a significant emphasis on strengthening its cybersecurity posture. The firm relies on third-party vendors and partners to provide the technology and expertise necessary to manage increasing risks in the digital realm.

To address these evolving risks, Gallagher has implemented a comprehensive cybersecurity framework, which includes a Security Operations Centre (SOC) to provide global incident response capabilities. The SOC works alongside the Cybersecurity Incident Response Team and a managed security service provider to handle potential security incidents in real time.[86]

Gallagher’s cybersecurity efforts are coordinated across various business functions. Security executives from information technology, legal, finance, accounting, data protection, and business divisions are responsible for ensuring the firm's security protocols align with each department’s needs. As part of its risk management approach, the firm also requires vendors whose services or products could present a cybersecurity risk to maintain cybersecurity insurance.

At the helm of Gallagher’s cybersecurity initiatives are the Chief Information Security Officer (CISO) and Chief Information Officer (CIO). The CISO, with 20 years of experience, previously held identical roles at Brighthouse Financial and GE Healthcare. The CIO brings over 30 years of technology leadership experience from companies like Aegon N.V., Citigroup, Inc., and J.P. Morgan Chase & Co.[87]

Gallagher’s cybersecurity practices are aligned with well-regarded industry standards, including the National Institute of Standards and Technology (NIST) Cybersecurity Framework and ISO 27001. The firm conducts an annual Analysis of Information Risk Assessment to assess its cybersecurity posture and identify areas for improvement.[88]

In addition to strengthening its own infrastructure, Gallagher’s acquisition strategy includes evaluating the cybersecurity capabilities of potential acquisition targets to ensure they meet the company’s security standards before any deal is finalized. From 2018’s daily conversations with Australian clients, Lyons said it’s concerning how many businesses lack cyber liability coverage or sufficient data breach plans following Australia’s implementation of the Notifiable Data Breach regulation during the same year. [89]

RISK FACTORS[90]

Gallagher has identified a range of risks that could materially affect its operations, financial performance, and long-term strategy. These risks, presented in the firm’s most recent annual report, span both internal and external factors, from acquisition-related challenges to macroeconomic pressures and evolving industry dynamics. While many of these are common to the broader insurance sector, Gallagher’s emphasis on growth through acquisition, middle-market specialization, and global expansion makes certain exposures particularly relevant. The firm’s proactive risk disclosures offer insight into where leadership sees the greatest potential vulnerabilities.

Acquisition Strategy Risks: Gallagher’s acquisition strategy has played a significant role in driving the firm’s growth. However, Gallagher acknowledges increasing challenges in continuing this strategy. Industry consolidation and heightened competition from private equity firms have made it more difficult and costly to find suitable acquisition targets.

Additionally, the firm faces risks associated with financing and integrating acquisitions, particularly with larger deals like its acquisition of AssuredPartners. These risks include potential cultural mismatches, retention issues, and regulatory hurdles that could undermine the expected benefits of acquisitions and disrupt the firm’s operations.

Competitive Pressures: Gallagher operates in a highly competitive landscape across its brokerage, reinsurance, and employee benefits consulting segments. The competition is fierce, with both large firms and smaller regional players vying for market share. The firm also faces increasing pressure from private equity-backed companies, insurtech start-ups, and tech-driven competitors who are challenging traditional business models.

Furthermore, the rise of substitutes for traditional brokerage services poses a threat. Large US financial firms are entering the insurance space, offering annuities and insurance policies, which puts additional pressure on Gallagher to remain competitive on price. Other competitive factors include the quality of services, expertise in risk management, data analytics capabilities, and the ability to offer personalized client attention. Potential legislative changes, such as the introduction of single-payer health systems or government-sponsored property insurance, could also disrupt the market, leading to lower premiums and new business models that may erode Gallagher’s competitive position.

Volatility in Premiums and Industry Trends: Gallagher’s profitability is closely tied to the cyclical nature of insurance and reinsurance premiums, which are influenced by broader market trends beyond the firm’s control. Currently, the industry is in a hardening cycle, characterized by high premiums driven by inflation, natural disaster rates, and demographic trends like the aging population. However, this cycle could come to an end as inflation cools in the US.

A downturn in premiums, combined with adverse trends such as reduced commission rates by underwriting enterprises or a shift toward alternative insurance markets (e.g., self-insurance, captives, or risk retention groups), could negatively impact Gallagher’s revenue. During Q4 2024, Gallagher reported a $7 million shortfall from projected figures, primarily due to increased loss ratios and underperformance in Canada. However, the firm indicated that this would not significantly affect overall revenue growth projections.[91]

Additionally, Gallagher faces challenges from the growing trend of flat-fee compensation models for brokers, which replace the traditional commission-based revenue tied to premiums (the majority of Gallagher’s revenue base). This shift could create revenue volatility and require adjustments to the firm’s financial strategies, potentially affecting profitability.

Global Economic and Geopolitical Risks: Global economic and geopolitical instability poses a significant risk to Gallagher’s operations. Factors such as fluctuations in interest rates, inflation, exchange rates, and geopolitical tensions could have a material impact on business conditions. Economic downturns, political crises, or trade disruptions – such as ongoing conflicts in Ukraine and the Middle East – could lead clients to reduce their insurance and consulting purchases or result in financial difficulties that hinder Gallagher’s ability to collect receivables.

Tightening credit markets, rising labor or capital costs, and lower inflation may also contribute to higher operating expenses, reduced profit margins, and slower revenue growth. Any significant economic or financial instability could hinder Gallagher’s ability to meet strategic and financial objectives, undermining the firm’s performance and financial stability.

Despite these risks, the firm’s management remains optimistic. During their Q4 2024 earnings call, Patrick Gallagher noted that despite a slower pace of activity compared to 2023, revenue growth throughout 2024 remained strong, with no clear signs of a global economic slowdown.[92]

Reputation and Cultural Risks: Gallagher considers its reputation one of its most valuable assets. A strong reputation is essential for attracting clients, maintaining relationships with investors, and retaining employees. The firm has built a culture of success over nearly a century, but as it expands into new markets, preserving this culture becomes more challenging.

Negative publicity, due to association with clients or partners involved in misconduct, cybersecurity breaches, or unfavorable social media coverage, could severely damage Gallagher’s standing in the market. In particular, reputational risks are heightened in emerging or smaller markets where the firm’s presence is more limited. A tarnished reputation, especially in today’s era of rapid information flow, poses a serious threat to Gallagher’s long-term stability and growth prospects.

SHARE PRICE STRATEGY AND INVESTOR POSITIONING

Gallagher’s stock performance has closely tracked its broader strategic momentum, with gains in earnings and investor confidence helping to sustain a strong valuation. While the firm generally avoids routine equity issuance, the 2024 purchase of AssuredPartners demonstrated a willingness to leverage public markets to fund transformative acquisitions. By issuing 30 million shares in its largest offering in years, Gallagher signaled that stock could serve as a strategic currency in pursuit of scale. That approach, while effective in this instance, invites questions about future valuations and market expectations should deal-making slow or industry conditions shift.

In 2024, the company’s average diluted earnings per share (EPS; earnings divided by all possible shares) reached $6.50, marking a 25 percent increase from the previous high of $5.19 per share in 2022. As of reporting, Gallagher’s outstanding shares number 255.74 million. Competitors Marsh & McLennan Companies, Inc. and Aon plc have diluted EPS of $8.17 and $12.51, respectively, with 492.9 million and 216 million outstanding shares.[93],[94]

The impressive uptick in Gallagher’s stock value is a direct result of higher annual earnings. A notable event in 2024 was the firm’s issuance of 30 million shares in a public offering, its largest by a significant margin in at least five years. Despite the sizable offering, Gallagher’s stock value held strong, with no discernible dilution of its average stock price for the year.[95]

The offering, priced at $280 per share, was tied to Gallagher’s landmark acquisition of AssuredPartners. According to Newsome, “There was an opportunity to buy something big, but they needed more capital than what was being generated by existing businesses.” In other words, when an attractive acquisition presents itself, Gallagher leverages its equity to fuel growth.

While Gallagher’s cash assets typically fund small acquisitions, leading to infrequent stock issuances, this public offering was an exception. The result has been stable market capitalization, with shares being used strategically to bolster acquisitions rather than fund general operations.

Despite the firm’s success in a favorable industry, Shields voiced some concern for overvaluation. “We do seem to be past the peak of rate increases in the property and casualty insurance industry. Broadly speaking, I’m worried that people will become increasingly concerned about the valuation of insurance brokers if overall property and casualty pricing slows or the economy and its growth slow.”

However, Shields also attributed much of Gallagher’s impressive valuation to the market’s recent recognition of the company’s exceptional business model. Investors have increasingly realized just how well-positioned Gallagher is, making it a standout player in the industry.

CREDIT OUTLOOK

Gallagher’s good creditworthiness continues to support its expansion strategy, with a stable outlook from Fitch Ratings as of late 2022. The rating, on par with Aon plc but a notch below Marsh & McLennan, reflects Gallagher’s resilient earnings, prudent capital deployment, and consistent access to liquidity. While the firm’s acquisition of AssuredPartners significantly boosts its revenue base, Fitch maintains that the deal aligns with Gallagher’s disciplined financial track record and will not materially shift its business risk profile. Analysts credit Gallagher’s sustained profitability and scale, even amid leverage-intensive growth, as key to preserving its current credit position.

Fitch attributes Gallagher’s strong rating to its position as the third largest global insurance broker, its solid financial flexibility, and its resilient earnings profile. The ratings agency highlights the company’s historically strong profit margins and its disciplined capital allocation approach, which focuses on strategic acquisitions and dividends. Despite Gallagher’s aggressive acquisition strategy, Fitch points out that the company has consistently performed well across economic cycles, benefiting from strong liquidity, a $1.7 billion unsecured revolving credit facility, and reliable access to capital markets.

While Gallagher’s recent acquisition of AssuredPartners is its largest to date, Fitch reported it would not materially alter the company’s business mix. However, it will meaningfully increase the company’s scale, adding more than 25 percent to revenue.[99]

Although Shields is not a credit analyst, he echoed Fitch’s sentiment, noting that Gallagher’s track record of excellent execution within a cash-generating industry supports a stable credit rating, even considering the debt leverage often involved in large acquisitions like that of AssuredPartners.

LEADERSHIP COMPOSITION AND INSTITUTIONAL TIES

Gallagher’s executive leadership and board are distinguished by a blend of deep familial continuity and strong industry connectivity. Several senior roles are held by descendants of founder Arthur J. Gallagher, underscoring a multigenerational commitment to the firm’s culture and direction. At the same time, both executives and board members bring significant experience from global insurance markets, consulting firms, and related sectors such as energy, healthcare, and consumer goods. Notably, many Gallagher leaders maintain active affiliations with organizations like Lloyd’s of London, the International Insurance Foundation, and major corporations, including NextEra Energy and The Plymouth Rock Company.

Several of Gallagher’s executive positions are filled by the descendants of founder (1927) Arthur J. Gallagher, including J. Patrick Gallagher Jr. (CEO and chairman of the board), Thomas Gallagher (President), and Patrick M. Gallagher (COO). J. Patrick Gallagher has worked for his family business since 1972, Thomas Gallagher since 1980, and Patrick M. Gallagher since 2000, each beginning as interns and moving through several positions before assuming their present executive roles. In addition to the three executives, six other Gallaghers work within various segments of their family business. Newsome acknowledged that any risk to the safety of J. Patrick Gallagher or other company-involved family members must be considered a risk to the firm.[100]

J. Patrick Gallagher Jr. is a founding director of the International Insurance Foundation, a nonprofit organization that supports the development of the global insurance industry through the education of insurance regulators and other professionals.[101] This likely aids Gallagher’s subsequently mentioned goals for expansion into the world’s developing insurance markets.

Since 2003, J. Patrick Gallagher Jr. has additionally been on the board of trustees for the American Institute for Chartered Property Casualty Underwriters.[102] It provides individuals in the industry with education, training, and certifications, its highest regarded being the Chartered Property Casualty Underwriter (CPCU) credential.

Douglas Howell joined Gallagher in 2003 as its Chief Financial Officer and is a remarkably prominent leader of the firm’s business strategy. He joined the firm with 20 years of financial services experience, beginning with PricewaterhouseCoopers (PwC) and KPMG.[103]

Mark Bloom, Gallagher’s Global CIO since 2022, held similar information and technology titles with the multinational life insurance, pension, and asset management company Aegon N.V., financial services firm Citigroup, and the leading financial institution J.P. Morgan Chase & Co.[104]

Global chief service officer Vishal Jain (with Gallagher since 2005) and CEO of risk management services Scott Hudson (2010) both began their careers with the global management consulting company McKinsey & Company.[105]

With regard to present interests outside of Gallagher:

Norman Rosenthal, chair of Gallagher’s risk and compliance committee and board director since 2008, is involved in the leadership of several other insurance firms. He’s currently the president of property and casualty insurance management consulting firm Norman L. Rosenthal & Associates, Inc., and affiliated partner to the private equity firm Lindsay Goldberg LLC. He presently sits on the board of The Plymouth Rock Company, a group of privately held auto and homeowners’ insurance companies.[106]

Since 2020, Chris Miskel has been chair of Gallagher’s nominating/governance committee and board director. Since 2017, he’s been President and Chief Executive Officer of blood product supply company Versiti, Inc. He also serves on the board of directors at the Medical College of Wisconsin.[107]

Deborah Caplan, a member of Gallagher’s compensation and nominating/governance committees and board director since 2014, joined the board of Valmont Industries in 2024, where she serves on the Human Resources Committee.[109]

As for common backgrounds:

Until 2024, NextEra Energy Inc., one of the largest publicly traded electric power and clean energy companies, was home to both Gallagher’s compensation committee chair, Sherry Barrat, and compensation and nomination committee member Deborah Caplan. Sherry Barrat was NextEra Energy’s lead director and a member of its compensation, governance, and nomination committees. Deborah Caplan also had a significant tenure at NextEra Energy, where she was Executive Vice President of Human Resources and Corporate Services.[110] Their collective experience at NextEra Energy provides them with insights into the US energy sector and corporate management that could influence their current roles, including their decisions at Gallagher.

Those affiliated with Lloyd's of London insurance marketplace include Gallagher committee member John Coldman, who served as the Deputy Chairman and was a Member of Council at Lloyd's of London from 2001 to 2006.[111] Likewise, from 1997 to 2023, independent Gallagher board member Richard Harries served as Chief Executive Officer and Director at Atrium Underwriters Limited, Lloyd's managing agent and syndicate. J. Patrick Gallagher Jr. has been recognized for his contributions to the Lloyd’s insurance market; Although not a direct executive or board member at Lloyd’s of London, in 2007 J. Patrick Gallagher was granted Freedom of the City of London by then-Lord Mayor Sir David Thomas Rowell Lewis, in recognition of his outstanding contribution to the Lloyd’s insurance marketplace.[112]

Independent Gallagher board members David Johnson and Ralph Nicoletti both had affiliations with Kraft Foods during their careers. Before 2007, David Johnson was President of Kraft Foods North America and a Member of the Management Committee. His responsibilities spanned marketing, strategy, operations, procurement, and general management. Ralph Nicoletti was the Senior Vice President of Corporate Audit and held other senior financial management roles.[113]

DECISION LEADERS

Since its founding in 1927, Gallagher has been a largely family business. Since 1995, the role and decisions of CEO have belonged to J. Patrick Gallagher. Other senior management decisions have since fallen to several of his scions, as detailed above. “It’s the Gallagher family, led by J. Patrick Gallagher Jr., Gallagher’s CEO, who are making the vast majority of the big decisions, and have been since the beginning,” said Newsome.

Nevertheless, Newsome doesn’t see Gallagher family involvement as a strategic risk to the firm, nor does he envision the company having evolved much differently with more outside influence. “There may be a little bit of decision making that’s related to the tradition of the Gallagher family... but J. Patrick Gallagher is famous for saying he’s fired a lot of cousins over the years. Everyone must perform, even if you’re related,” said Newsome.

Likewise, Gallagher is not devoid of non-family influence. A responsible assessment of Gallagher’s strategic leadership begins with the dynamic between J. Patrick Gallagher, CEO, and Douglas Howell, CFO for 23 years, said Shields.

Their CEO and CFO dynamic is not merely close colleagueship, but an outstanding strategy among insurance brokerage firms, said Shields. Since the early 2000s, their colleagueship has involved Gallagher’s CEO prioritizing revenue generation, while Gallagher’s CFO has been delegated laser focus on managing expenses. “That works phenomenally well, operationally,” he said.

This was shown in action during Gallagher’s recent major acquisition of AssuredPartners. As retold in the firm’s Q4 2024 earnings call made on January 30, 2025:

J. Patrick Gallagher brought forward the strategic acquisition, aiming to expand his firm's commercial middle market, niche practice areas, and opportunities for its data and analytics. The similarities of Gallagher and AssuredPartners’ culture and operational models signaled revenue growth, he said during the recent earnings call. On the financial side of this strategy, CFO Douglas Howell managed the capital raise and structuring of $13.5 billion in cash. This included a $5 billion debt issuance and equity offering – apparently the only impact of AssuredPartners' acquisition. Howell’s decision, along with deferred tax benefits and interest income, was said to have kept Gallagher’s capital flexibility and earnings profile intact during the landmark acquisition.[114]

Another example of J. Patrick Gallagher’s and Douglas Howell’s strategic colleagueship includes Howell’s optimization of 2025’s profit margins to 50 to 100 basis points, by adjusting for interest income, debt servicing costs, and rolling M&A impacts. This was in line with J. Patrick Gallagher’s continued focus on expanding its organic revenue base.[115]

EXECUTIVE COMPENSATION

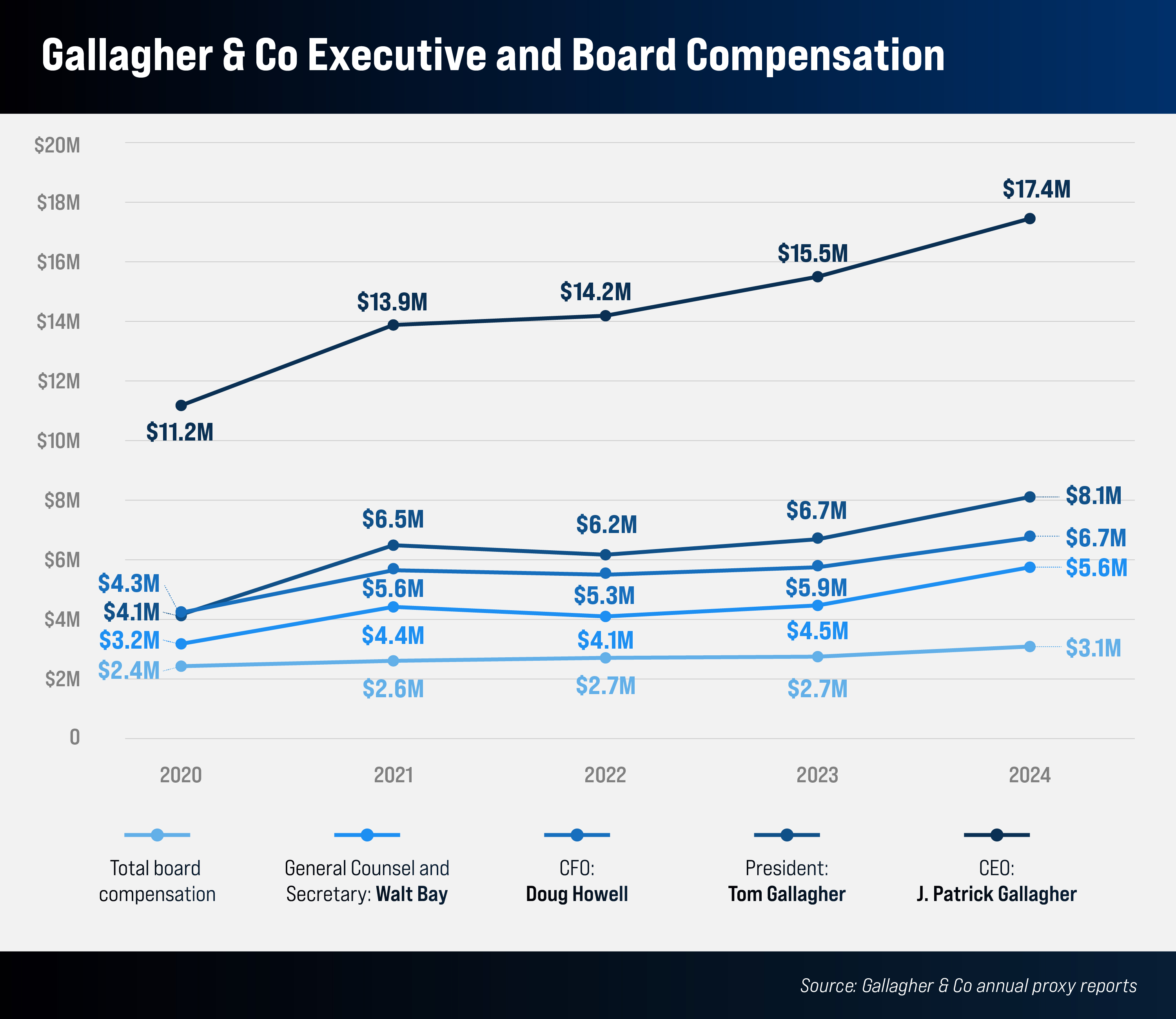

Between 2020 and 2024, executive compensation at Gallagher rose significantly, reflecting both the company’s financial performance and strategic realignment in incentive structures. CEO J. Patrick Gallagher’s total compensation climbed from $11.18 million in 2020 to $17.45 million in 2024 – a 56 percent increase – driven largely by rising long-term incentive awards. President Thomas Gallagher experienced a similarly sharp increase, with his compensation nearly doubling from $4.2 million to $8.1 million, while CFO Doug Howell’s pay grew by 55 percent to reach $6.74 million. General Counsel and Secretary Walt Bay also saw a substantial bump, with his compensation rising 77 percent to over $5.6 million. Notably, the role of COO (Patrick Gallagher) emerged on the executive payroll in 2024 with compensation of $5.75 million. Total board compensation followed a gentler curve, increasing by roughly 27 percent over the same period to just over $3 million.

Despite these increases, a comparative market assessment revealed that Gallagher’s executive compensation was modest relative to peers. While CEO Pat Gallagher’s target long-term incentives were at the 50th percentile, the rest of the named executive officers fell below that mark. Short-term incentives were notably below the 50th percentile across the board. To bring compensation more in line with industry standards, particularly in light of performance, the Compensation Committee approved significant adjustments. Long-term incentive targets were increased from 150 percent to 200 percent of salary for executives other than the CEO and from 435 percent to 500 percent for Pat Gallagher. Annual cash incentive targets were similarly raised: from 125 percent to 150 percent for other executives and from 225 percent to 265 percent for the CEO.